Filter by Topic: Capital Advisory / Corporate Advisory / Corporate Finance / Deal Structuring / Due Diligence / Financial Advisory / Integration Planning / Mergers & Acquisitions / Separation Support / Valuation

A critical part of any M&A transaction, valuation is often the top reason for a transaction’s success or failure. As a seller, a business understandably seeks as high a price as possible but oftentimes placing an unrealistic value on your business will be a death knell into an otherwise strategically sound deal. As a buyer, the risks are to either undervalue the target leading to a rejected transaction, or to overpay and set yourself up for future financial losses.

Any M&A transaction inevitably involves emotion on both sides and getting a quality unpartial advise is your key to success. C-Suite Alliance's Valuation Analysts provide independent valuation services for buyers and sellers alike, across multiple asset classes. Our advisers are certified and apply robust valuation methodologies.

Valuing a business in the context of an M&A transaction presents technical challenges relative to a business - as - usual valuation. C-Suite Alliance's valuers are experienced in identifying and quantifying various synergies between the acquirer and the target, as well as potential roadblocks in merging the businesses that would call for financial outlays.

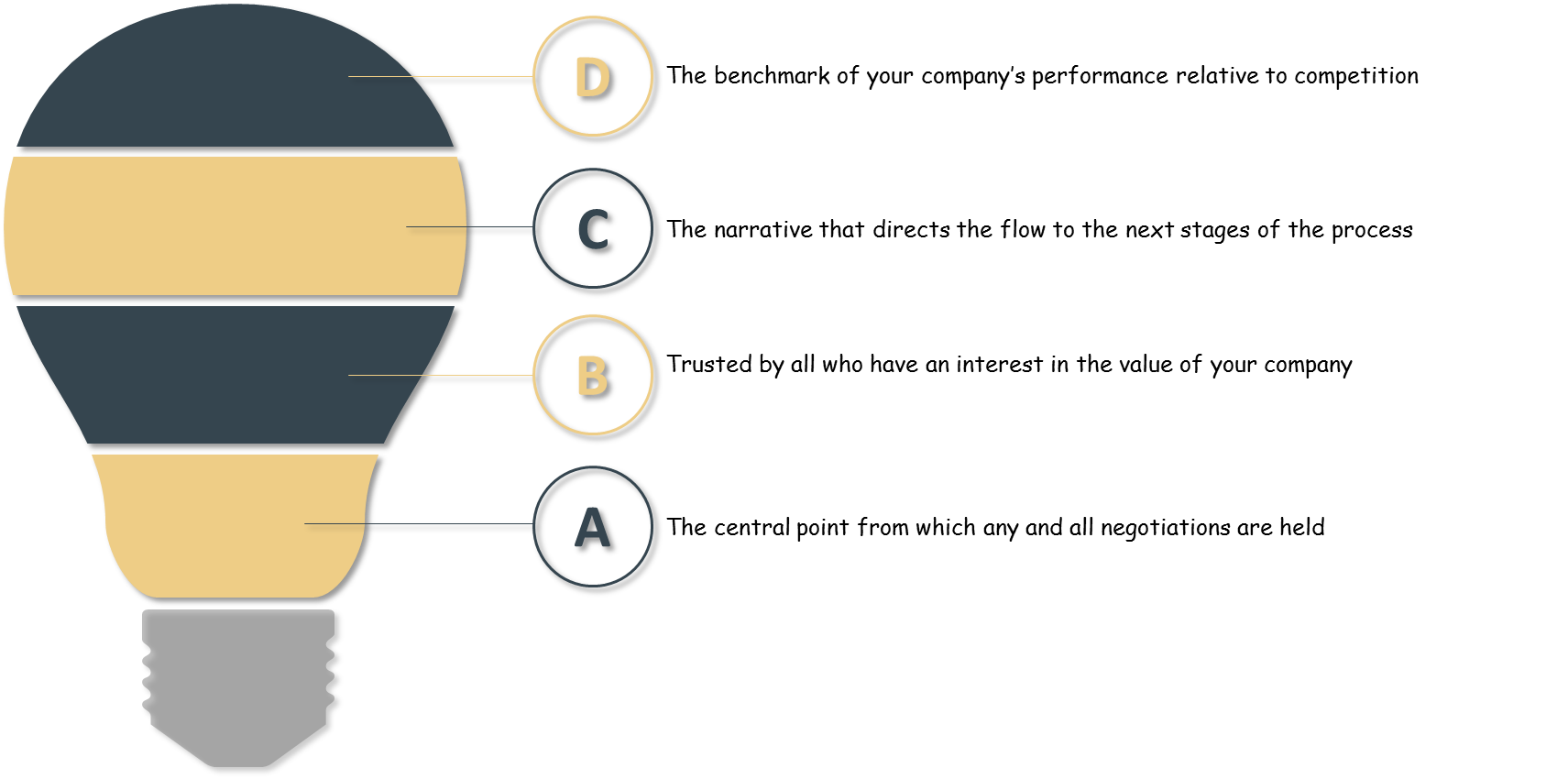

C-Suite Alliance Valuation of your business will be:

We account for any and all assets, including Property, Plant and Equipment, Real Estate, Intangible Assets, Intellectual Property, Human Capital, Derivative products, among others.

C-Suite Alliance firmly believes that objectivity and precision are crucial to developing a Fair Valuation of any company. We will stress - test all your assumptions, run sensitivities scenarios and develop an unbiased forecast. Use of a third party advisory will help all parties remove uncertainty of bias and develop high level of trust.