Filter by Topic: Capital Advisory / Corporate Advisory / Corporate Reliance / Deal Structuring / Due Diligence / Financial Advisory / Integration Planning / Mergers & Acquisitions / Separation Support / Valuation

Most M&A transactions are complex and the ultimate success of a transaction relies on many specialized factors, including sound strategic drive, accurate valuation, legal and tax consideration as well as careful integration planning. One of the key factors to success, however, remains your company’s financial capacity to complete the transaction and to support the integration process. Simply put, if your company runs out of cash, no amount of strategic rationale or planning will help complete a deal.

C-Suite Alliance M&A Capital and Financial Advisory team will lead you in determining the best financial structure for your transaction. We will support you in sourcing and securing access to required capital, with a focus on the right balance between capital availability, cost of capital and risk.

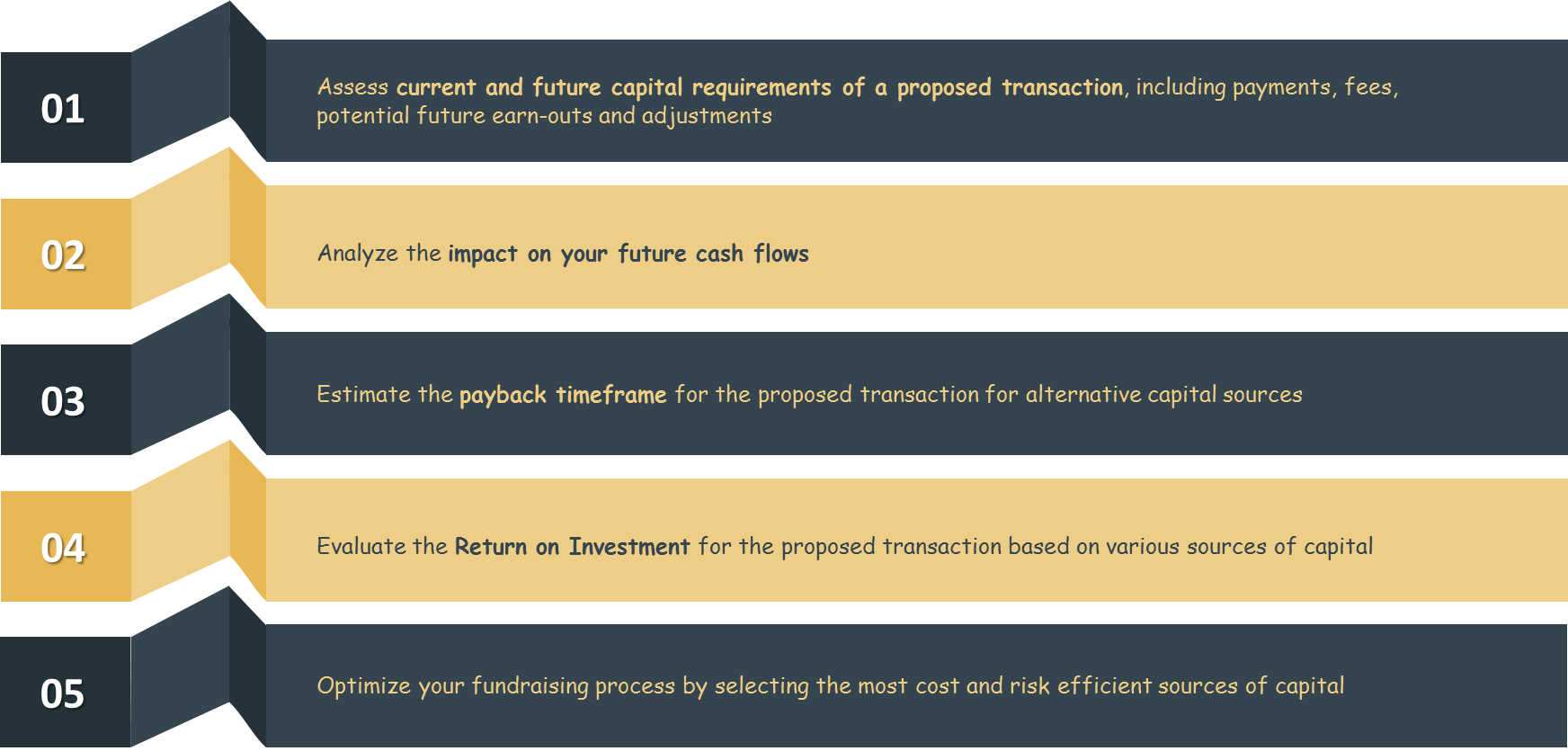

C-Suite Alliance M&A Capital and Financial Advisory solutions will allow you to:

Whether you look to raise public or private equity capital, issue preferred debt, gain bank financing or effect a leveraged buyout, C-Suite Alliance Capital and Financial Advisory team has the breadth of expertise to make your MA deal a success.